Synchrony Bank Review: Maximizing Your Savings with High Rates

Synchrony Bank: No fees, high rates, optimal savings.

Synchrony Bank emerges as a standout in the realm of online banking, offering a suite of savings-centric accounts without the encumbrance of monthly fees. Recognized for its high-yield savings and certificate of deposit (CD) accounts, Synchrony caters to savers aiming to optimize their earnings in a digital-first environment. While the lack of a checking account or in-depth budgeting tools may narrow its appeal for some, the attractive rates and customer-friendly features present compelling reasons to consider Synchrony for your savings strategy.

Features:

- High-Yield Savings Account: Boasts a 4.75% APY with no minimum balance or monthly fees.

- Money Market Account: Offers flexibility with a 2.25% APY, including check-writing capabilities.

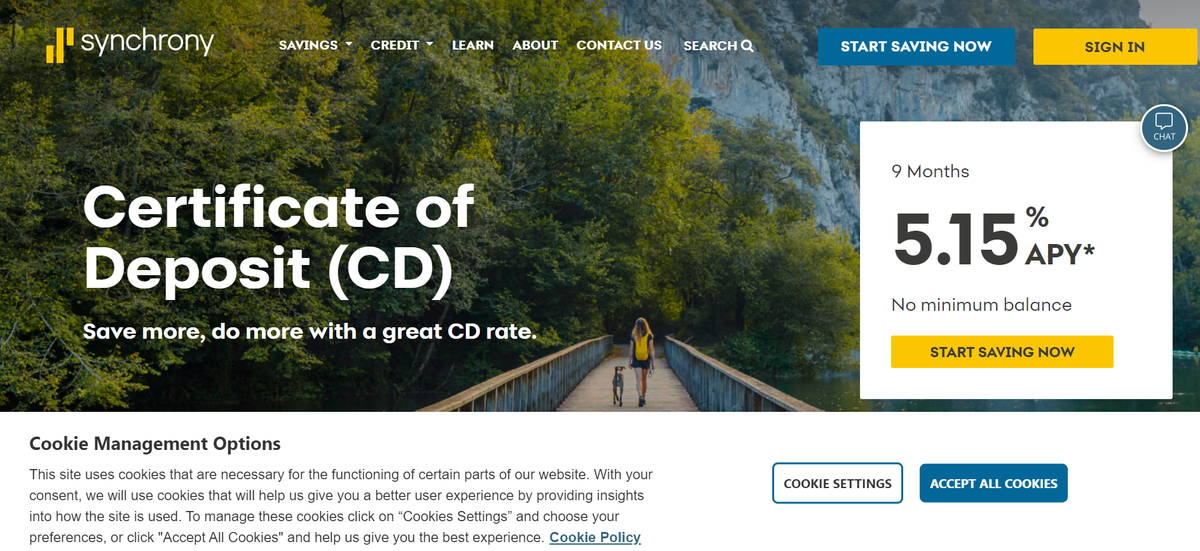

- Certificates of Deposit: Competitive rates like a 4.90% APY for a one-year term, with no minimum deposit to start.

- ATM Fee Rebates: Provides a monthly $5 rebate for fees incurred at domestic ATMs.

Benefits:

- Competitive Interest Rates: Among the highest available, maximizing potential deposit earnings.

- No Monthly Fees or Minimum Deposits: This makes it accessible and cost-effective to start saving.

- ATM Accessibility: The optional ATM card enhances access to funds across the Plus or Accel networks.

- Diverse CD Options: Including standard, no-penalty, and bump-up CDs, catering to different saver needs.

Product Summary:

Synchrony Bank is ideally suited for savers focused on accruing interest without the hassle of fees or minimum deposit requirements. Though it operates exclusively online, offering no checking accounts or physical branches, Synchrony compensates with its superior savings and CD rates, free ATM access, and flexible money market account. While the bank may not provide personalized saving tools or the convenience of in-person banking, its competitive rates and user-friendly online and mobile platforms make it an appealing choice for those prioritizing savings growth in a digital setting.