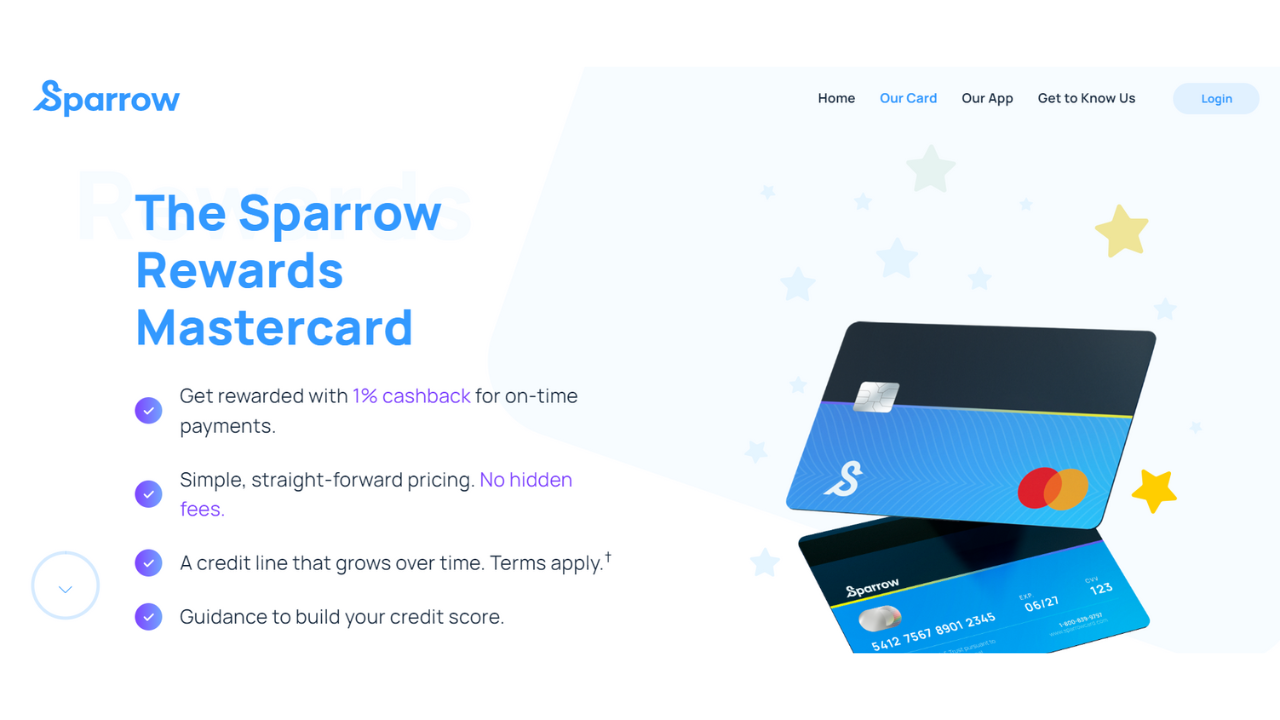

Sparrow Rewards Mastercard® Review: Empowering Credit Growth

Sparrow Mastercard: Build credit, 1% cash back, no deposit needed.

Features

- Annual Fee: $59 for the first year, $99 thereafter.

- Rewards Rate: 1% cash back on all purchases, conditioned on on-time payments.

- Credit Reporting: Regular reporting to the three major credit bureaus.

Benefits

- Instant Use: Immediate access to a virtual card upon account approval.

- Credit Building: Designed to help rebuild your credit; potential for a credit limit increase within six months.

- User-Friendly App: Access to a leading mobile app with features like real-time notifications and a free credit score.

- Zero Fraud Liability: Protection against unauthorized charges.

- Unsecured Credit: No security deposit required, freeing up personal capital.

Drawbacks

- Higher Annual Fee: Increases after the first year, which may be a consideration for budget-conscious users.

- High APR: Features a relatively high variable purchase APR, which can accumulate significant interest on carried balances.

Product Summary

The Sparrow Rewards Mastercard® is tailored for individuals looking to rebuild their credit. It offers a simple cash back rewards program and the unique feature of immediate virtual card access, allowing for instant use. The card's structure encourages good credit habits through rewards for on-time payments and regular credit bureau reporting. While the card comes with a higher annual fee after the first year and a high APR, it remains a valuable tool for those aiming to enhance their credit score while enjoying the flexibility of an unsecured credit line.