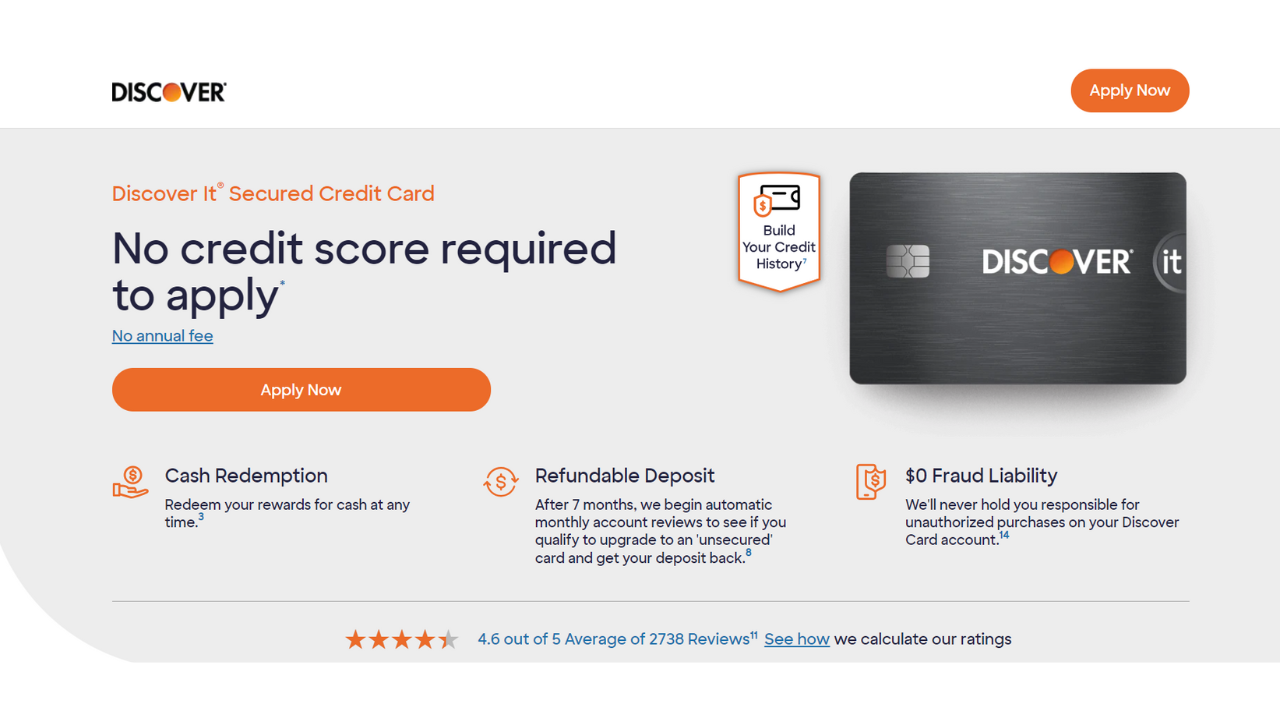

Discover it® Secured Credit Card: A Comprehensive Review

Discover it® Secured: Build credit with 0% annual fee, cashback rewards, and no penalty APR

Features

- APR for Purchases: 28.24%, variable with the market based on the Prime Rate.

- APR for Balance Transfers: 10.99% introductory rate for the first 6 months from the date of the first transfer for transfers posted by June 10, 2024. The post-introductory rate at 28.24%.

- APR for Cash Advances: 29.99%, also variable with the Prime Rate.

- Penalty APR: Not applicable.

- Interest-Free Period: At least 25 days after the close of each billing cycle.

- Minimum Interest Charge: Not less than $0.50.

- Annual Fee: None.

- Transaction Fees:

- Balance Transfer: 3% intro fee on transfers by June 10, 2024. Afterwards, 5%.

- Cash Advance: The greater of $10 or 5% of the advance amount.

- Penalty Fees:

- Late Payment: Up to $41 after the first late payment.

- Returned Payment: Up to $41.

- Calculation Method: Daily balance, including new transactions.

Benefits

- No Annual Fee: Cost-effective for those building or rebuilding credit.

- Introductory APR: Lower initial cost on balance transfers.

- Interest-Free Purchase Period: Avoid interest by paying the balance in full by the due date.

- Cashback Rewards: Earn 2% at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% on all other purchases.

- Flexible Redemption: Cashback can be redeemed at any amount, anytime.

- Security Deposit: Refundable, providing a path to a traditional credit card.

Drawbacks

- High APR: The standard APR is relatively high, particularly for purchases and cash advances.

- Initial Deposit Required: A security deposit is necessary, which might be a barrier for some applicants.

- Fees on Balance Transfers and Cash Advances: Additional costs could add up.

Product Summary

The Discover it® Secured Credit Card is designed for individuals looking to build or rebuild their credit. With no annual fee, the card offers a practical way to manage credit while earning rewards on everyday purchases. The card's benefits, including cashback on gas and dining, interest-free periods on purchases, and the potential to transition to an unsecured card, make it a compelling option for those new to credit or working to improve their scores. However, its high APR and initial deposit requirement are factors to consider.