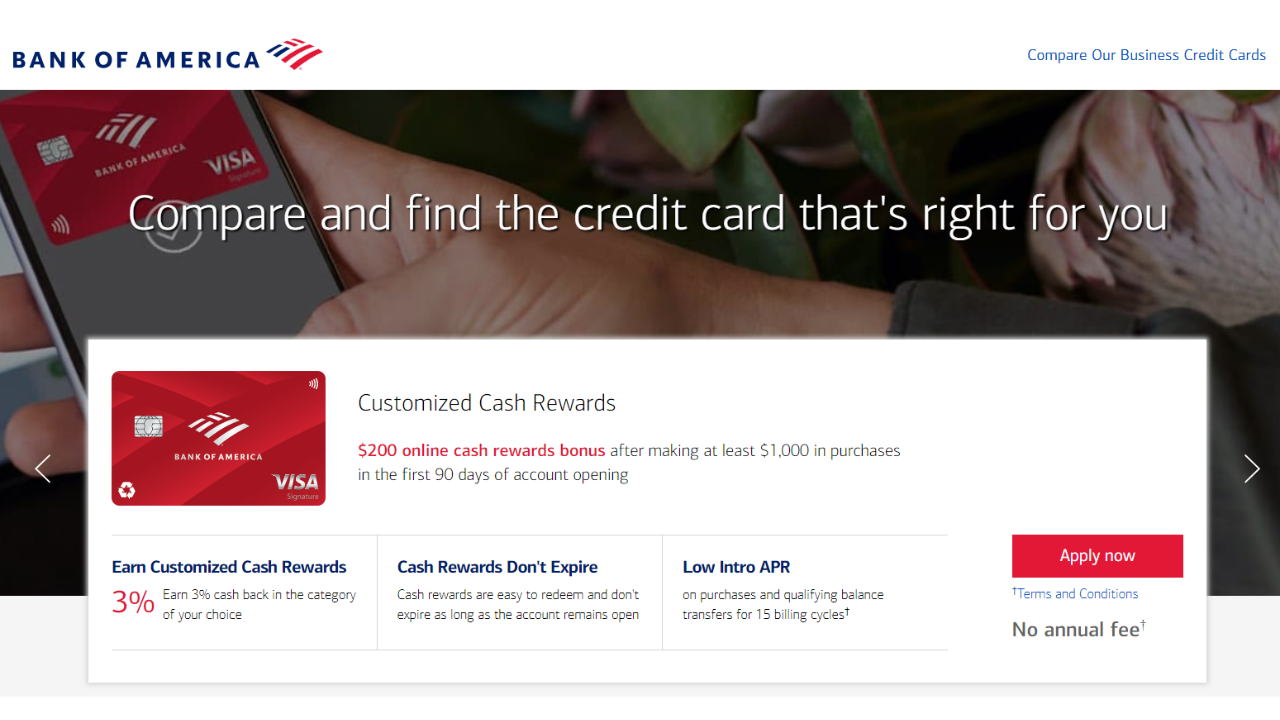

Bank of America Customized Cash Rewards Review: Tailor Your Rewards

Customize your rewards with BofA's card, plus a $250 bonus and 0% APR.

Features

- Annual Fee: $0 intro for the first year, then $95, making it accessible for those testing its value.

- Rewards Rate: Earn 3% cash back in a category of your choice and 2% at grocery stores/wholesale clubs (on up to $2,500 in combined choice category/grocery store/wholesale club quarterly purchases), plus 1.5% on all other purchases.

- Sign-Up Bonus: $250 bonus after spending $2,000 within the first 120 days, offering immediate value.

- Intro APR: 0% for 15 billing cycles on purchases and balance transfers, followed by a Variable APR of 18.24%-28.24%.

Benefits

- Customizable Rewards: Flexibility to choose your 3% cash back category from online shopping, dining, and more options.

- Rewards for Banking Customers: Bank of America Preferred Rewards members can earn 25%-75% more cash back on every purchase.

- Broad Redemption Options: Cashback can be redeemed for statement credits, deposits into BofA accounts, or at checkout with certain merchants.

Drawbacks

- Spending Caps: The quarterly spending caps can limit your rewards, making it less suitable for high spenders.

- Modest Rewards Without Loyalty Bonuses: Without qualifying for Bank of America Preferred Rewards, the rewards rates are relatively modest compared to other cards.

- Requires Good/Excellent Credit: May not be accessible for those with lower credit scores.

- Complicated Rewards: Managing bonus categories and understanding loyalty program tiers might be cumbersome for some users.

Product Summary

The Bank of America Customized Cash Rewards credit card distinguishes itself with its flexible rewards program, allowing cardholders to choose their 3% cash back category from a diverse list. With bonus rewards for grocery/wholesale club purchases and a generous sign-up bonus, this customization positions it as a strong contender in the cash-back card market. While the card's annual fee is waived for the first year, its value can be maximized by those participating in the Bank of America Preferred Rewards program, significantly increasing the cash-back rates. Ideal for individuals with varied spending habits and Bank of America banking customers, this card offers an appealing mix of flexibility, earning potential, and additional perks, such as a 0% intro APR period and no expiration on rewards.